- 15 Oct 2024

- 1 Minute to read

Understanding a DARWIN's quote

- Updated on 15 Oct 2024

- 1 Minute to read

What does the DARWIN's quote mean?

The DARWIN's quote is determined by the return of the DARWIN since its inception. All DARWINs start with a quote of 100.

Introduction

A DARWIN is a special financial asset whose quote is not determined by the supply and demand of the market, but by the return obtained when replicating the trades from an underlying signal trading account.

Additionally, the volume of a trade in a DARWIN is not decided by the underlying trading strategy, but by the Risk Engine designed by Darwinex Zero.

Where can I see a DARWINs quote/price?

1. On its profile

Every DARWIN is listed with a base of 100.

This means that, at birth, all DARWINs will quote at 100.

2. On its return curve

This curve reflects the return in terms of a percentage.

This means that all DARWINs are listed starting at 0% (quote value = 100) and historic return is added to the starting quote of 100.

Initial value

All DARWINs start with a quote of 100 and a return of 0%.

Current quote

As the underlying strategy carries out trades, the DARWIN will replicate these trades with a position size determined by Darwinex Zero's Risk Engine.

The result of replicating these trades provides a return that will add to, or subtract from, the value of the DARWIN's initial quote and its return.

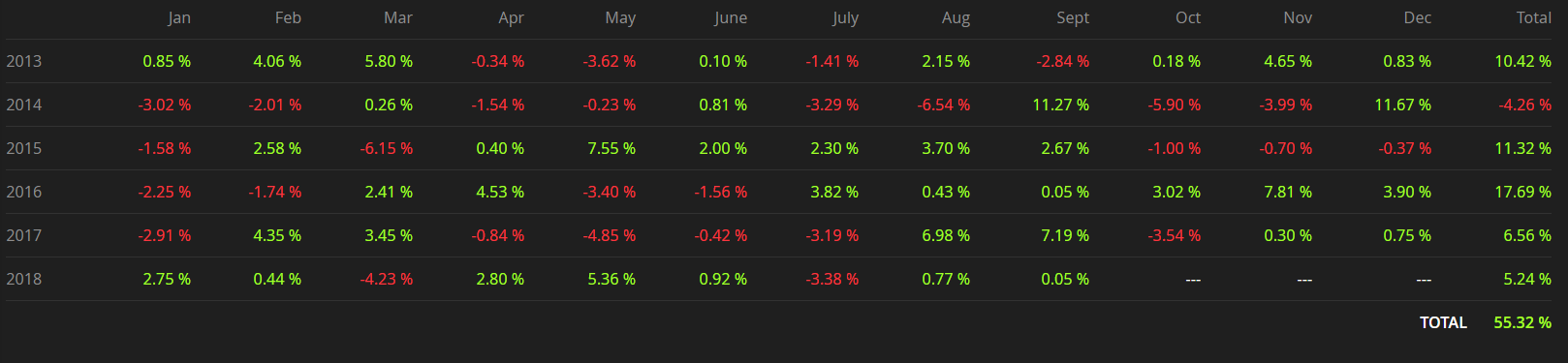

Monthly returns

The percentage results for each month can be seen just below the DARWIN's return chart, in the ''Return/Risk'' tab.

Quote history

We can also see the return curve of any DARWIN on its return chart and the historic quotes on candle format as well:

The price shows what an investor would have theoretically obtained if they had invested in the same currency as the underlying strategy (EUR, USD or GBP), with an initial value of 100.

The value and the return of a DARWIN are calculated based on the opened and closed trades up to that precise moment, taking into account commissions, spreads, and swaps.