- 13 Apr 2023

- 1 Minute to read

Difference between a DARWIN and its underlying signal account

- Updated on 13 Apr 2023

- 1 Minute to read

DARWIN vs. Signal Account

A DARWIN automatically replicates trades opened/closed by the trader in different assets within their signal account. However since Darwinex Zero standardises risk across DARWINs (3.25-6.5% target monthly VaR), our Risk Engine determines the size of the trades the DARWIN will open independently of the trader.

Due to the existence of this layer of risk management overlay, the results of the signal account and associated DARWIN may differ.

Example DARWIN vs. Signal Account

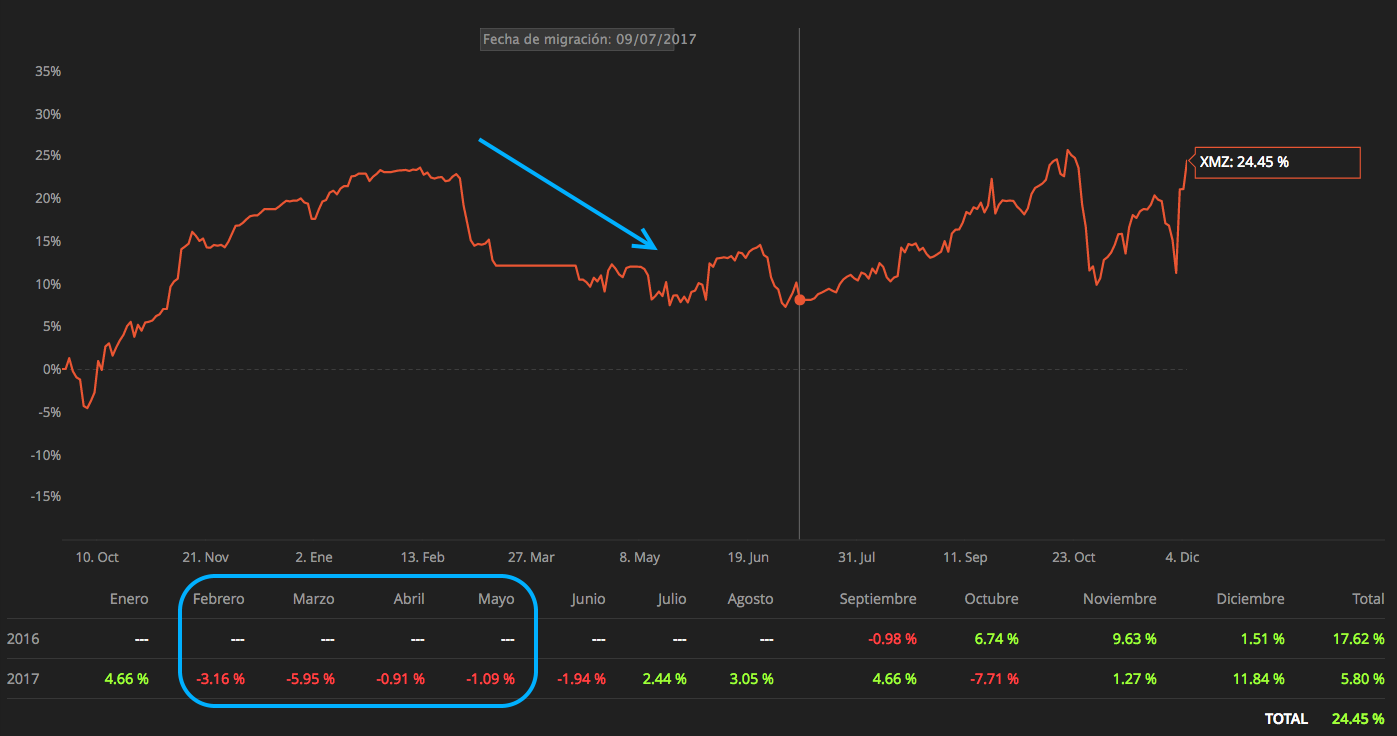

On this chart, we can see that during the months of February to May in 2017, the trader had a few months of important consecutive losses from which they have still not recovered.

The VaR during these months fluctuated between 40% and 65%.

However, the return of the associated DARWIN shows a much more contained loss in the same period of time, our Risk Engine ensuring that the risk level taken on by the DARWIN has oscillated between 6.5% and 3.25% monthly VaR. This has enabled the DARWIN to recover from its drawdown much more easily.

While the Risk Engine manages and standardizes the risk it does not eliminate risk. Investors should also look to minimize portfolio risk through diversification.

Do you want to learn more?

If you want to learn more about the differences between DARWIN and its underlying strategy, we encourage you to watch the following tutorial: