- 31 Mar 2023

- 3 Minutes to read

How to calculate the profit and loss of a trade in commodities

- Updated on 31 Mar 2023

- 3 Minutes to read

How to calculate the P&L and the cost of a trade in commodities

Learn how to calculate the P&L and the cost of a trade in commodities based on the table of assets.

Check out the table of assets and spreads

Go to the table of assets.

Click the "Commodities" tab to access information about commodities.

The columns you'll need to check out for this calculation are the following:

- Tick value

- Swap long

- Swap short

- Commission

Additionally, you'll need to know the number of contracts (lots) you are trading. The table indicates both the standard contract size and the minimum tradeable size.

Calculate the trade's P&L

All commodities trade in US dollars thus the P&L we'll calculate will be in US dollars.

Based on tick value

The tick is the last decimal of the price.

Calculate the P&L of the trade by multiplying the ticks gained or lost by the tick value and the number of contracts.

When buying 2 contracts of XAUUSD at 1200.00 and selling at 1210.00 (1000 ticks):

1000 ticks 1 USD (tick value) 2 contacts= 2000 USD

Based on price

Another way of calculating P&L of a trade is based on its price according to the formula (close price - open price) / open price * trade value.

To calculate the trade value, just multiply the contract size by the open price and the number of contracts.

When buying 2 contracts of XAUUSD at 1200.00 (trade value is 100 * 1200.00 * 2) and selling at 1210.00:

(1210.00 - 1200.00) / 1200.00 * 100 * 1200.00 * 2 = 2000 USD

Choose how to display P&L in Metatrader

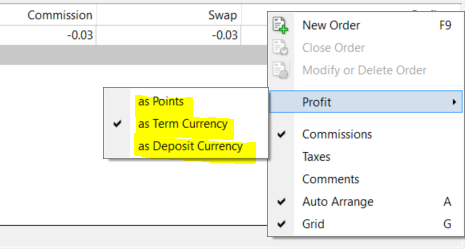

To display the P&L of trades in commodities in the Metatrader terminal you may choose between points (ticks), term currency (USD) or deposit currency.

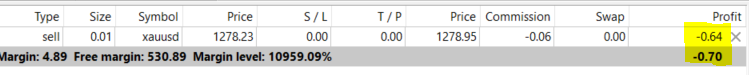

'Profit' in Metatrader does not include the cost of a trade.

Only the amount that appears in bold in the last row of the 'Profit' column includes the whole cost (commission and swap).

Calculate the cost of a trade

The cost of a trade consists of commission + swap.

Commission

For commodities we charge 0.005% of trade value.

The whole commission gets charged at the opening of the trade and no additional commission is charged afterwards.

To calculate the commission, it´d be as easy as to multiply the trade value by 0.005%.

In order to calculate the trade value, just multiply the contract size by the open price and the number of contracts. When opening 2 contracts of XAUUSD at 1200.00:

100 * 1200.00 * 2 * 0.005% = 12 USD

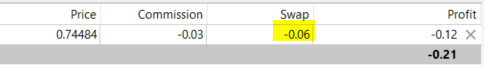

The commission is always displayed in the base currency in the MetaTrader terminal.

Swap or rollover

When holding on to positions for longer than a day, investors borrow an asset (on which interest is payable) to invest in another (on which they earn interest).

Swap for commodities is charged daily and in triple size on Wednesdays (Fridays for XAUUSD), with net interest settled on a daily basis at 21:00 UTC showing the difference between interest paid and earned.

Swap settlement is positive whenever interest earned on the invested asset exceeds interest on the borrowed asset - the investor gets paid. However, the swap is a cost whenever the opposite is true.

For calculating the swap to be charged in case of a trade remaining open upon daily market rollover (21:00 UTC), use the following formula: swap as indicated in table of assets and spreads, and number of contracts.

The swap displayed in the Metatrader terminal is the swap accumulated over the days the trade was open upon daily market rollover (21:00 UTC), but the rate charged each day may be different.

The swap for the current day can be checked out in the table of assets and is updated usually during the afternoon.

Swap is always displayed in the base currency in the MetaTrader terminal.