- 16 Jul 2024

- 2 Minutes to read

Return calculation method

- Updated on 16 Jul 2024

- 2 Minutes to read

What is it?

Return refers to the financial result associated with an investment decision.

How is it calculated?

Darwinex Zero calculates the return for a position or timeframe as a percentage of the equity used for a given position or at the start of a given timeframe.

The following information is taken into account:

- Closed trades / realized profit or losses

- Open trades / unrealized profit or losses

- Deposits & withdrawals* of money from the account. This is done so the percentage return is reflected correctly.

By calculating return based on equity, deposits and withdrawals do not affect the percentage return. This is done so that a trader can't artificially skew his results by depositing or withdrawing money.

Example

1- A trader with €1,000 in his account opens a trade that is generating a profit of €50 (5%).

2- Before closing the position he decides to withdraw €950.

3- Seconds later, he closes the trade.

Darwinex splits this trade into 2 positions with the following result:

Position 1 (finishes before the withdrawal of €950):

Initial Equity => €1,000

Final Equity => €1,050

Return => 5%

Position 2 (starts after the withdrawal of €950 and finishes with the trade being closed):

Initial equity => 100 €

Final equity => 100 €

Return => 0%

Compound return of both positions => 5%

Where can I see it?

In Darwinex Zero it is important to distinguish the DARWIN return from that of the signal account.

It is the DARWIN return that is relevant for the DarwinIA seed capital allocations programs and outside investors, since both back the DARWIN and not the underlying signals account.

DARWIN

On My DARWIN page, you can see the return chart for one of the pre-set timeframes offered by Darwinex.

By left-clicking and dragging on the mouse, you can zoom in on a specific period to see the % return for a custom time period.

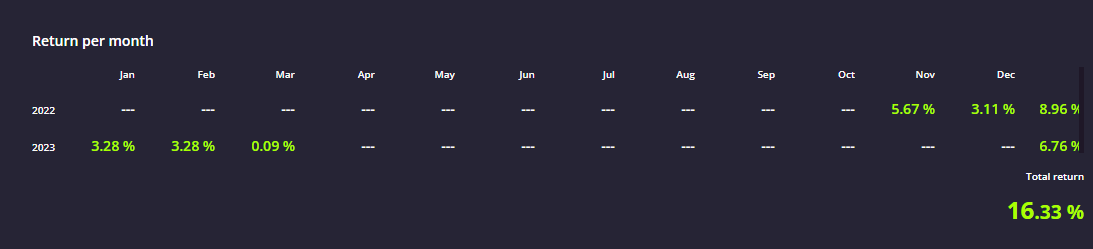

Right below, there is a table showing returns per month, year and since the inception.

Signal account

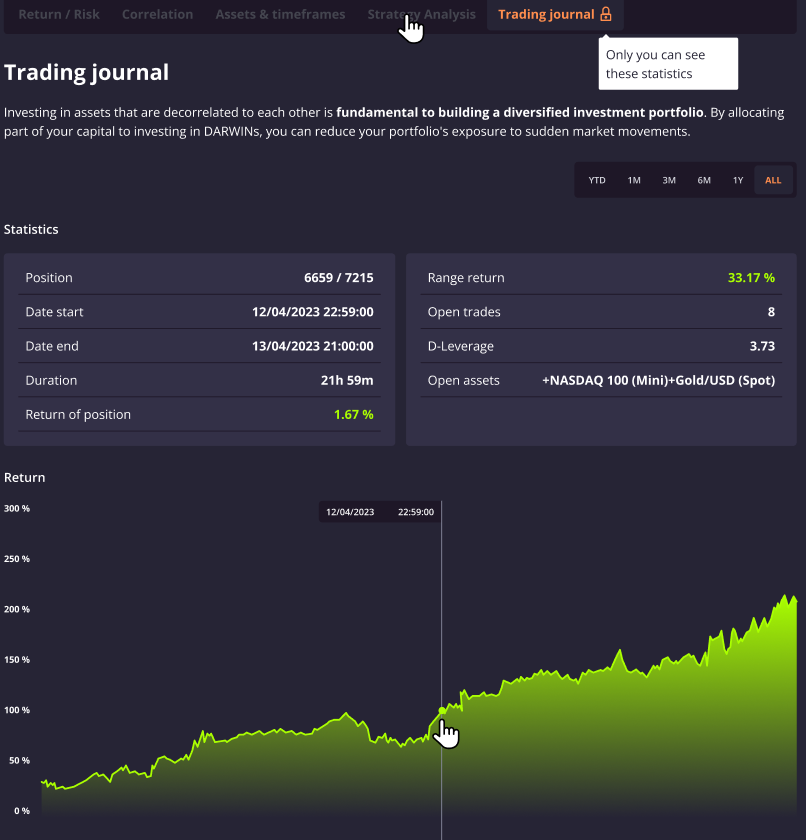

You can see the signal account performance graph in the "Trading journal" section:

Return on summary tables is compounded and not summed. The total cumulative return does not match the sum of the monthly returns.

This is because the cumulative return over a period is calculated by compounding the returns of the constituent sub-periods, and not by simply adding them up, by using the following mathematical formula:

[(1+(R1/100)) * (1+(R2/100)) * (1+(R3/100))* (1+(Rn/100))... -1] * 100

Adding the results would match the result of withdrawing the profits achieved in every single period.