- 31 Mar 2023

- 2 Minutes to read

Trading commissions and swaps

- Updated on 31 Mar 2023

- 2 Minutes to read

When placing trades in the financial markets, it is important to take into account the costs associated.

Execution commissions

When you open any trade in your trading account, there is an execution fee applied for placing that order. The execution cost will depend on the asset you are trading, as well as the open volume of the trade.

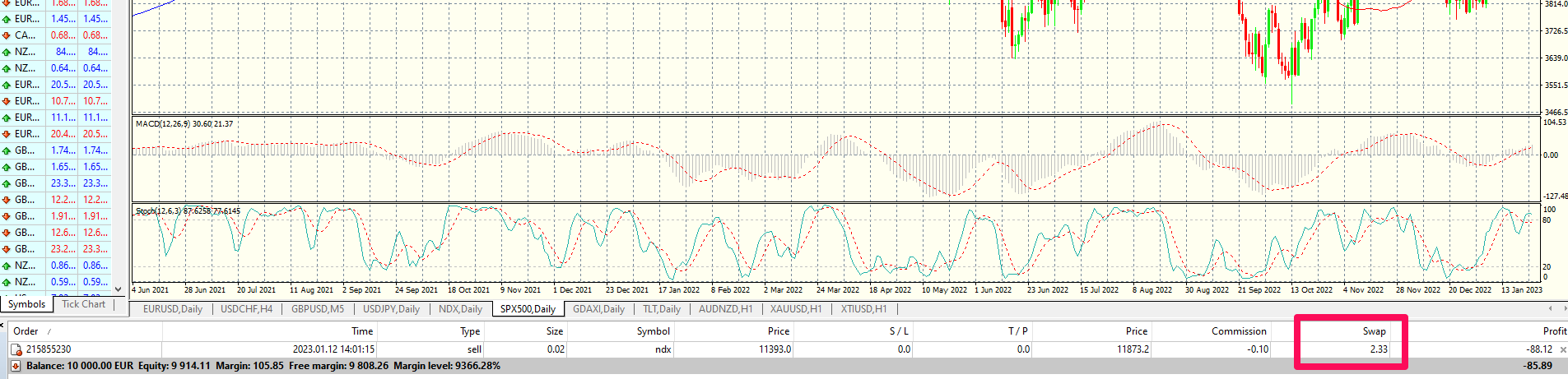

In our MetaTrader platform, you will be able to check the commission paid per trade in the column "Commissions":

You can check the execussion commission per asset here

Swap or rollover

In the spot currency market, all transactions must be settled in two business days. To avoid the obligation from a trader to deliver to its counterparty the currency that he/she is selling, and vice versa, the broker makes use of a figure called rollover or swap.

Rollover is the simultaneous closing of an open trade at today's date (T + 0), and the automatic opening of the same asset the following day (T + 1) at a price that reflects the interbank interest rate differential between the two currencies.

Thus, when you have an open position, and want to keep it overnight (rollover period), you will receive or pay a fee, which will be the result of the difference in interest rates between the 2 currencies that form the currency pair.

Swap rates are settled daily at 5:00 p.m. (New York time), except on Friday, which is settled on Sunday at 5:00 p.m. (New York time).

Rates are are tripled on Wednesday since they'll include the liquidation of Friday, Saturday and Sunday.

A swap rate is an overnight or rollover interest (that is earned or paid) for holding positions overnight.

Positive swap

When the interest rate of the currency you have purchased, along with the markup that liquidity providers apply, is higher than the interest rate of the currency you have sold, you will receive the difference in your account at 17:00 New York Time.

Negative

When the interest rate of the currency you have purchased, along with the markup that liquidity providers apply, is less than the interest rate of the currency you have sold, you will pay the difference at 17:00 New York Time.

However, swaps are not only based on interest rates differentials, they also take into account credit risk, the underlying instrument volatility, and other factors.

Note that trading at Darwinex Zero implies trading with virtual funds and paying a monthly subscription. Consequently trading commissions & swaps are taken into account in terms of how they affect the underlying signal account and associated DARWINs performance. Darwinex Zero clients however will never be charged these fees to their credit cards.

In our MetaTrader platform, you will be able to check the total amount of negative / positive swaps accumulated during the days in which the trade has remained open.