- 11 Apr 2024

- 2 Minutes to read

Futures basics

- Updated on 11 Apr 2024

- 2 Minutes to read

What is a future?

A futures contract is an agreement to buy or sell a specific underlying asset at a set future date. The underlying asset can be a commodity, a security or any other financial instrument.

In Zero futures contracts, the culmination of a contract occurs at the the expiration date of the contract. This is the moment when the contractual agreement reaches its conclusion, and the exchange of the underlying asset takes place between the two parties involved in the contract, theoretically.

However, in Zero futures trading, as there is no exchange taking place, the close date would be the point in which the position would be closed.

What is the difference between a CFD and a future?

OTC vs regulated exchange

CFDs are financial derivatives traded over-the-counter (OTC), which involves that every broker may provide a different liquidity feed, conditions, and specifications. OTC products are subject to regulatory oversight by financial authorities in the jurisdictions where they are offered.

Futures contracts, on the other hand, are traded on regulated exchanges, such as the Chicago Mercantile Exchange (CME) in our case. These exchanges have specific rules and regulations governing trading activities, including margin requirements, position limits, and trade execution standards.

Contract Standardization

CFD contracts are typically customizable, allowing traders to specify the size and duration of their positions. However, they are not standardized and may vary between different brokers.

Futures contracts are standardized in terms of contract size, expiration date, and delivery specifications.

Leverage and Margin

CFD trading has up to 30:1 leverage, although it varies from different assets.

Futures trading also involves leverage, but margin requirements are set by the exchange and may be lower compared to CFDs. This can vary depending on the asset class and market conditions.

Margin requirements in futures are not stablised similar to CFDs, as it is a nominal amount. For example, if ZC (Corn) future margin requirement per contract is $1,400, this is the minimum equity you should have to open 1 contract trade, and will be the margin retained at MetaTrader 5. If the nominal value of 1 ZC contract is $22,000, it would mean that actual max. leverage is around 16:1.

In order to calculate the nominal value of any contract, it is needed to multiply the contract size by the current quote of the contract and the price quotation (monetary unit) of that contract.

For example, for CZ contract, the size of the contract is 5,000, if the current quote is 440 and the price quotation is US cents (0.01 monetary units), the nominal value per contract would be: 5,000 x 440 x 0.01 = 22,000$

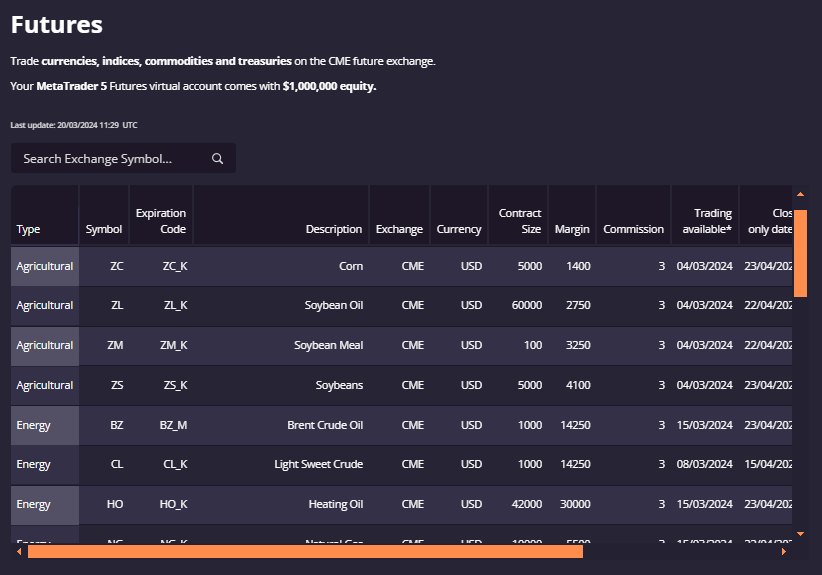

This information can be seen here:

*Note that CME futures conditions are defined by CME.

Costs

The CFD is a financial derivative instrument with daily expiration. Hence, for maintaining open a trade overnight, there is a swap charge applied. There is an execution commission as well, apart from spreads.

Futures costs include brokerage commissions and exchange fees, which may vary depending on the contract specifications, but there is no swap for keeping trades open from day to the next one.

Specifications

You may check the specifications of each contract in CME (Chicago Mercantile Exchange) website.