- 31 Mar 2023

- 2 Minutes to read

MetaTrader order types

- Updated on 31 Mar 2023

- 2 Minutes to read

The following orders are used in the MetaTrader terminal: Market order, Pending order, Stop Loss and Take Profit.

Client terminal allows to prepare requests and also requests the broker for execution of trading operations. Moreover, it allows to control and manage open positions.

For these purposes, several types of trading orders are used.

An order is a client's commitment to a brokerage company to perform a trade operation.

These are the orders that can be used in the MetaTrader terminal: Market order, Pending order, Stop Loss and Take Profit.

Market Order: A market order is a commitment to the brokerage company to buy or sell a security at the current price.

Execution of this order results in the opening of a trade.

Securities are bought at the ASK price and sold at the BID price.

Stop Loss and Take Profit orders (described below) can be attached to a market order.

Pending Order: A pending order is the client's commitment to the brokerage company to buy or sell a security at a pre-defined price in the future.

This type of order is used for the opening of a trade provided the future quotes reach the pre-defined level.

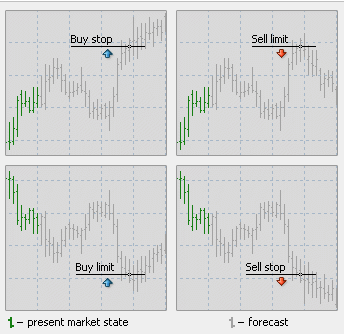

There are four types of pending order available in the MetaTrader terminal:

- Buy Limit Order— A buy limit order is an order to purchase an asset at or below a specified maximum price level.

- Buy Stop Order— A buy stop order is an order to purchase a security only once the price of the security reaches the specified stop price.

- Sell Limit Order— A sell limit order is a sell order to sell an asset at or above a specified minimum price level.

- Sell Stop Order—A sell stop order is a stop order to sell at a market price after a stop price parameter has been reached.

Orders of Stop Loss and Take Profit can be attached to a pending order. After a pending order has triggered, its Stop Loss and Take Profit levels will be attached to the open position automatically.

Stop Loss Order: A Stop Loss order is an order placed with a broker to buy or sell a security when it reaches a certain price. Stop Loss orders are designed to limit an investor’s loss on a position in a security. When an asset falls below the stop price the order becomes a market order and it executes at the next available price.

Take Profit order: A Take Profit order is a type of limit order that specifies the exact price at which to close out an open position for a profit.

Attention:

- Execution prices for all trade operations are defined by the broker

- Stop Loss and Take Profit orders can only be executed for an open position, but not for pending orders;

- History charts are drawn only for BID prices in the terminal. To enable the display of the latest bar ASK price, one has to flag the "Show Ask line" in the terminal settings.