- 31 Mar 2023

- 2 Minutes to read

What is VaR (Value-At-Risk)?

- Updated on 31 Mar 2023

- 2 Minutes to read

What is Value at Risk (VaR)?

The VaR or Value at Risk is a forward looking way of measuring the risk of an investment which answers the questions how much you might lose, how likely it is, and over what timespan.

VaR and statistical confidence levels

It is impossible to have 100% accuracy when it comes to making predictions about the future. Therefore, VaR must be accompanied by a statistical confidence level and a time horizon. It's common to work with confidence levels of 90%, 95%, or even 99%.

The higher the confidence level is, the more constrained the risk will be.

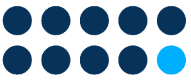

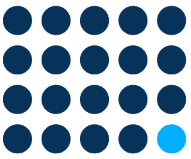

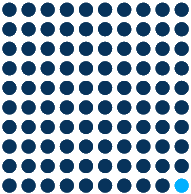

Darwinex Zero works with 6.5% monthly target VaR using a 95% confidence level. This means that DARWINs mighte be expected to lose 6.5% or more 1 month out of 20, or 5% of the time.

Conversely, 95% of the time or 19 months out of 20, this same investment will make more than -6.5%.

90%

95%

99%

Using VaR to estimate future risk

VaR is a forward-looking measure, unlike drawdown which describes what happened in the past, and since risk describes what could happen to your money in the future, it's related to a target horizon.

At Darwinex Zero this horizon is 1 month.

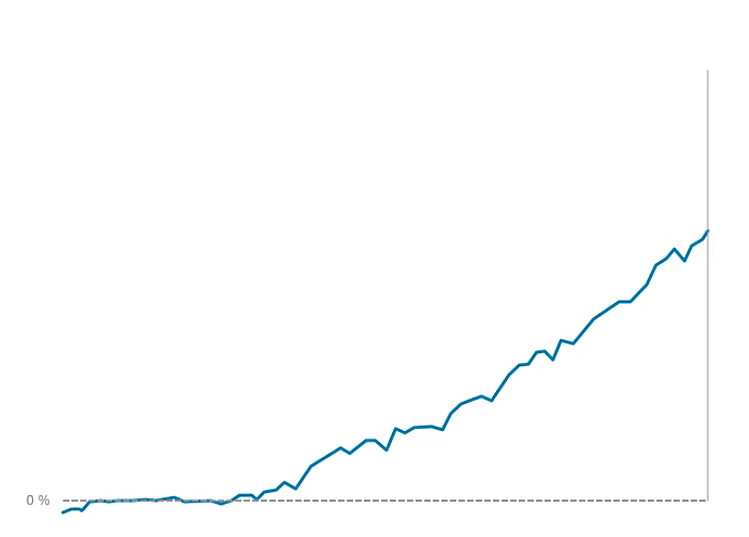

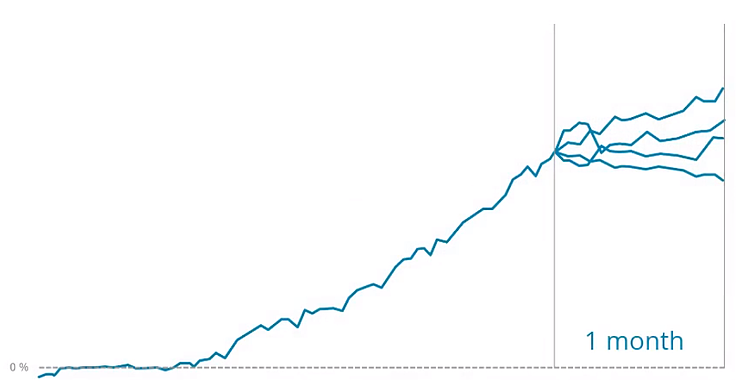

In this chart, you can see how return on a sample investment evolves over time.

What could happen to the return of this investment in the next month?

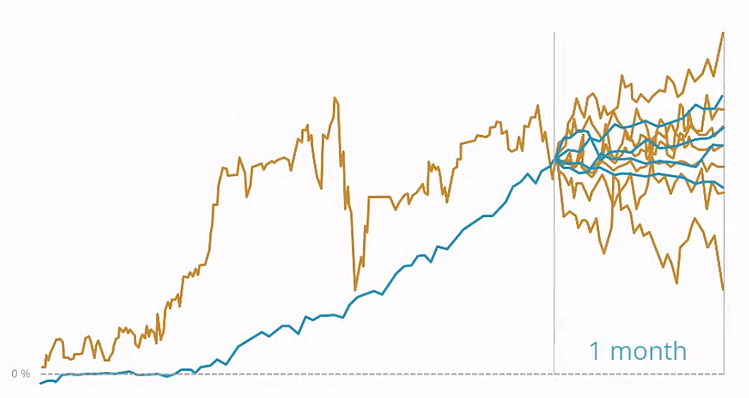

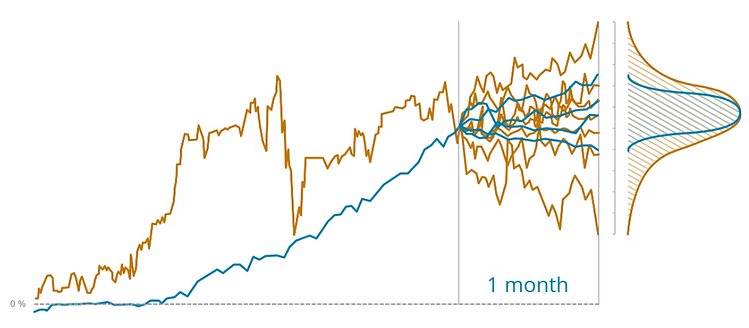

In order to respond to this question, different scenarios get projected taking into account both historical data and thousands of Monte Carlo simulations matching both the risk and investment style.

Projections for investments with lower volatility will present lower volatility than projections for investments with higher volatility which will result in more dispersed scenarios.

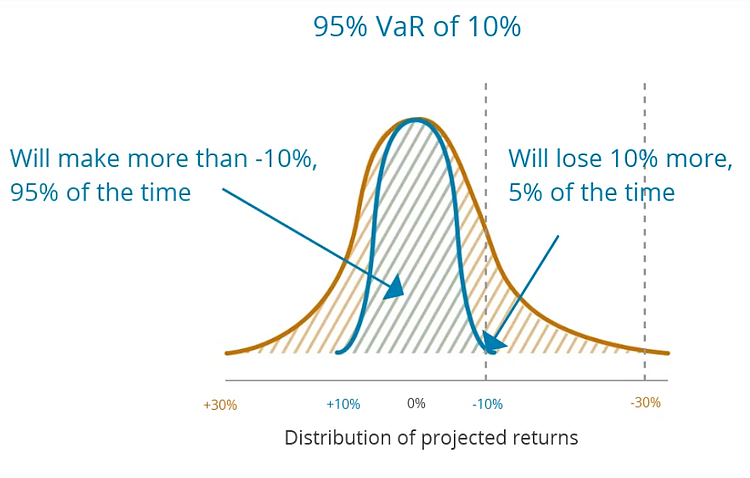

These return projections are plotted on a distribution graph.

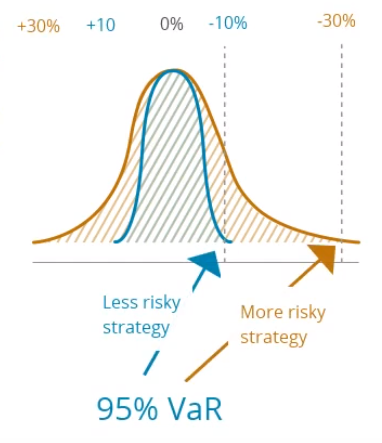

95% VaR will be situated at the 95% percentile of the distribution graph.

As an example, an investment having a monthly Value at Risk of 10% might expect to lose 10% or more 1 month out of 20 or 5% of the time.

What characteristics of an investment affect risk (VaR)?

- Trade frequency.

All other things being equal, the more trades in an investment, the higher its risk.

- Leverage and duration of trades.

All other things being equal, the higher the leverage and the longer the duration of the trades, the higher the risk.

- Market volatility and correlation of assets.

The higher the volatility and the correlation of the assets traded, the higher the risk.